Income Tax Slabs for FY 2026-27 (New vs Old Regime)

What is Income Tax Slab?

Income tax in India is levied based on a slab system, where different income ranges are taxed at different rates. As your income goes up, the tax rate on the higher income also increases. This system ensures that those with higher incomes pay a larger percentage in taxes.

Union Budget 2026: No Change in Income Tax Slabs

In the Union Budget 2026, the Finance Minister did not announce any changes in tax slabs or basic exemption limits. The slabs that were announced in the previous budget remain in force for FY 2026-27 (AY 2027-28).

As per the Income Tax Act, the slabs are revised periodically by the government through the Union Budget. Taxpayers can now choose between the New Tax Regime (lower tax rates but fewer deductions) and the Old Tax Regime (higher rates with multiple exemptions and deductions).

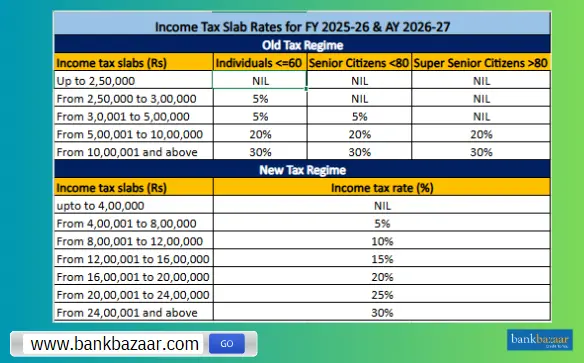

Income Tax Slabs for FY 2026-27

New Tax Regime

Income Tax Slab | Tax Rate |

Up to Rs.4 lakh | Nil |

Rs.4 lakh – Rs.8 lakh | 5% |

Rs.8 lakh – Rs.12 lakh | 10% |

Rs.12 lakh – Rs.16 lakh | 15% |

Rs.16 lakh – Rs.20 lakh | 20% |

Rs.20 lakh – Rs.24 lakh | 25% |

More than Rs.24 lakh | 30% |

- Rebate: For income up to Rs.12 lakh, no tax needs to be paid. Under the new regime, there is a rebate of Rs.60,000. However, this rebate does not apply in case of special tax income.

- Surcharge: 25% is the maximum surcharge rate for income more than Rs.2 crore.

- Senior Citizens: Under the new regime, no beneficial slab rates are provided for senior citizens.

Old Tax Regime

Individuals Below 60 years, HUF, and NRIs

Income Tax Slab | Tax Rate |

Up to Rs.2.5 lakh | Nil |

Rs.2,50,001 – Rs.5 lakh | 5% |

Rs.5 lakh – Rs.10 lakh | 20% |

More than Rs.10 lakh | 30% |

Aged Between 60 Years and 79 Years

Income Tax Slab | Tax Rate |

Up to Rs.3 lakh | Nil |

Rs.3 lakh – Rs.5 lakh | 5% |

Rs.5 lakh – Rs.10 lakh | 20% |

More than Rs.10 lakh | 30% |

Aged 80 Years and Above

Income Tax Slab | Tax Rate |

Up to Rs.5 lakh | Nil |

Rs.5 lakh – Rs.10 lakh | 20% |

More than Rs.10 lakh | 30% |

Tax Slabs for Domestic Companies

Sections | Tax rate | Surcharge |

Normal Rate (Turnover ≤ ₹400 crore) | 25% | 7% or 12% |

Section 115BAA | 22% | 10% |

Section 115BAB | 15% | 10% |

Others | 30% | 7%/12% |

Note: Companies under section 115BA face a 7% surcharge for income over Rs.1 crore and 12% above Rs.10 crore. Under sections 115BAA and 115BAB, the surcharge is fixed at 10% regardless of income.

Income Tax Rates for LLPs and Partnership Firms under Both Regimes

A partnership firm or an LLP is taxable at 30%

Note -

- A Surcharge of 12% is levied on incomes above Rs.1 crore.

- Health and Education Cess Rate - 4 %

Deductions and Exemptions under New Tax Regime

The new tax regime comes with changes that impact the deductions and exemptions available to taxpayers. While some deductions are still allowed, many from the old tax regime are no longer applicable.

Below is a detailed comparison of the deductions allowed and deductions not allowed under the new tax system:

Deductions Allowed Under the New Tax Regime

Deduction | Description |

Transport Allowance (for differently-abled individuals) | Taxpayers with disabilities can still claim this allowance. |

Conveyance Allowance for Work-Related Travel | Travel expenses related to work remain deductible. |

Compensation for Travel Costs on Transfer/Tour | Travel costs during official transfers or tours are deductible. |

Daily Allowance for Work-Related Absence | Expenses incurred during work-related travel can be claimed. |

Perquisites for Official Use | Perquisites for official purposes remain exempt. |

Exemption for Voluntary Retirement, Gratuity, and Leave Encashment | Exemptions under Sections 10(10C), 10(10), and 10(10AA) remain in place. |

Standard Deduction | Rs. 75,000 |

Interest on Home Loan for Let-Out Property | Interest on loans for rented properties continues to be deductible under Section 24. |

Gifts up to Rs. 50,000 | Non-cash gifts up to Rs. 50,000 are exempt from tax. |

Family Pension Deduction (Section 57(iia)) | Increased from Rs. 15,000 to Rs. 25,000 |

Employer’s NPS Contribution (Section 80CCD(2)) | Employer's NPS contribution increased from 10% to 14% (Budget 2024). |

Additional Employee Costs (Section 80JJA) | Deductions for employing new workers are allowed. |

Contributions to Agniveer Corpus Fund (Section 80CCH(2)) | Contributions to this fund are deductible. |

Deductions Not Allowed Under the New Tax Regime

Deduction | Description |

Professional Tax and Entertainment Allowance | These allowances on salaries are no longer deductible. |

Leave Travel Allowance (LTA) | LTA is no longer available under the new tax regime. |

House Rent Allowance (HRA) | HRA deductions for rent payments are not available. |

Allowances for MPs/MLAs | Deductions for allowances given to MPs and MLAs are removed. |

Helper Allowance | Any allowance paid for hiring helpers is no longer deductible. |

Children’s Education Allowance | This allowance is no longer tax-deductible. |

Special Allowances (Section 10(14)) | Special allowances (such as reimbursements) are no longer deductible. |

Interest on Housing Loan for Self-Occupied or Vacant Property | Interest on loans for self-occupied or vacant properties is not deductible under Section 24. |

Minor Child Income | Income earned by a minor child is no longer exempt. |

Deductions under Sections 80TTA and 80TTB | Deductions for savings account interest (Section 80TTA) and senior citizens' interest (Section 80TTB) are not available. |

Deductions under Sections 80C, 80D, and 80E | These deductions (except Section 80CCD(2) and 80JJAA) are no longer allowed. |

Additional Depreciation (Section 32(1)(iia)) | The provision for additional depreciation on business assets is removed. |

Deductions under Sections 32AD, 33AB, and 33ABA | Specific investment-related deductions are not available. |

Scientific Research Deductions (Sections 35(2AA), 35(1)(ii), (iia), (iii)) | Deductions related to scientific research are no longer allowed. |

Deductions under Sections 35AD or 35CCC | Business-related deductions under these sections are not available. |

Exemption for SEZ Units (Section 10AA) | SEZ units are no longer exempt under Section 10AA. |

Exemptions for Perquisites or Allowances (e.g., Rs. 50 per meal) | Perquisites like meal allowances are no longer exempt. |

Employee's NPS Contribution | Employees can no longer claim deductions for their own NPS contributions. |

Donations to Political Parties or Trusts | Donations to political parties or trusts are not deductible. |

Surcharge

What is a Surcharge?

A surcharge is an additional levy imposed on the base income tax of individuals whose income exceeds certain thresholds. It is essentially ‘tax on tax,’ meaning it is calculated as a percentage of the tax payable rather than the total income.

The purpose of a surcharge is twofold:

- It ensures that individuals with higher incomes contribute proportionally more to the government’s revenue.

- It allows the government to generate additional funds from higher-income groups without altering the basic tax slabs applicable to all taxpayers.

The surcharge rate varies depending on the total taxable income and the chosen tax regime (Old or New). Certain types of income are exempt from the higher surcharge rates to maintain fairness. Specifically, capital gains under sections 111A, 112, 112A and dividend income have a maximum surcharge cap of 15%, except for special cases under sections 115A, 115AB, 115AC, 115ACA, and 115E.

Surcharge Rates for FY 2026-27

Income Level (Rs.) | Old Tax Regime | New Tax Regime |

Up to 50,00,000 | Nil | Nil |

50,00,001 to 1,00,00,000 | 5% | 5% |

1,00,00,001 to 2,00,00,000 | 15% | 15% |

2,00,00,001 to 5,00,00,000 | 25% | 25% |

More than 5,00,00,000 | 37% | 25% |

Key points:

- The surcharge is applied only on the income tax amount, not on the total income.

- Higher-income earners are subject to higher surcharge rates, reflecting the progressive nature of taxation.

Rebate

What is a Rebate?

A rebate is a reduction in the income tax liability of resident individuals whose taxable income falls below a specified threshold. Unlike deductions, which reduce taxable income, a rebate directly reduces the tax payable. The main purpose of a rebate is to reduce the tax burden on lower-income earners, making the tax system more equitable.

The rebate limit and eligibility differ depending on the tax regime:

Rebate Details for FY 2026-27

Regime | Maximum Rebate | Income Allowed within Rebate |

Old | Rs.12,500 | Rs.5 lakh |

New | Rs.60,000 | Rs.12 lakh |

Key points:

- In the old tax regime, if taxable income is at or below the threshold, the full rebate is available. There is no marginal relief, meaning if the income slightly exceeds the limit, the rebate is entirely lost.

- In the new tax regime, marginal relief ensures that taxpayers whose income slightly exceeds the threshold can still claim a partial rebate. This prevents a sudden increase in effective tax liability.

Old vs New Tax Regime - Comparison of Income Tax Slabs

India has two distinct tax regimes: the Old Tax Regime and the New Tax Regime (the default choice). Each of these regimes utilizes a different method for determining a taxable salary.

For the Financial Year (FY) 2025‑26 (Assessment Year 2026‑27), Indian taxpayers can choose between two tax regimes to calculate income tax: the New Tax Regime and the Old Tax Regime. The New Tax Regime is the default option. If no choice is made, your taxes will be calculated under this regime.

Quick Comparison: New vs Old Regime

Feature | New Tax Regime (Default) | Old Tax Regime |

Tax Slabs | Lower, more granular slabs | Higher slabs |

Major Deductions | 80C, 80D, 80E, HRA, LTA- mostly not allowed (few exceptions) | Allowed (up to Rs.1,50,000 under 80C, 80D, 80E, etc.) |

HRA & LTA Exemptions | Not allowed | Allowed |

Standard Deduction | Rs.75,000 (private) / Rs.1,00,000 (central government employees & pensioners). Note: For the Financial Year 2025-26, the standard deduction under the New Tax Regime is a flat Rs.75,000 for all salaried individuals and pensioners, regardless of whether they are government or private employees. | Rs.50,000 |

Professional Tax | Deductible | Non-Deductible |

Simplicity | Simple; fewer proofs needed | More complex; requires proof of investments and expenses |

- If you have tax-saving investments and exemptions (HRA, LTA, 80C, etc.), the Old Regime may save more tax.

- If you don’t claim deductions, the New Regime is usually simpler and may reduce tax liability due to lower slabs.

Change of Regime for different types of income

With the Finance Act 2024, taxpayers have the option to choose between new and old tax regimes, however the processes involved depend on the type of income earned.

Non-Business Income

If taxpayers earn income from non-business activities (salary, pension, rent, interest, or other passive income), taxpayers are allowed to switch tax regimes every financial year because individuals and HUFs can optimise tax liability every year based on the deductions or exemptions claimed.

How to switch:

1. Choose your desired regime in income tax return (ITR): The current ITR forms allow taxpayers to declare whether they want to be assessed under the new or old regime for that assessment year.

2. File the ITR before the due date under Section 139(1): You must file your return by the due date, to ensure the regime you choose is effective for that year.

Legal significance and benefits:

1. Provides year-to-year flexibility for salaried employees and pensioners.

2. Allows taxpayers to optimise tax liability depending on their deductions or exemptions.

3. Provides compliance simplicity since direct compliance is with the ITR (no additional forms are required).

Business or Professional Income

Taxpayers that earn business or profession income have greater certainty as occasional regime switches are regulated to ensure intentional decisions and minimize switching simply for tax planning reasons.

Opting out of the new regime:

Taxpayers need to file Form 10-IEA on or before the ITR due date under Section 139(1). This will formally notify the tax department that the taxpayer is opting out of the new regime and is following the old regime instead of the new default regime.

Re-entering back into the new regime:

Taxpayers can re-enter the new regime by filing Form 10-IEA prior to the due date under Section 139(4). The option to switch this way is permitted once for a taxpayer with business/professional income. This option can be exercised in a subsequent assessment year only and not in the same year as the election to opt out.

Reasons why this is important:

- It provides assurance that taxpayers are taking well-considered decisions instead of switching on a whim for a minor tax benefit.

- It allows taxpayers to have a clear legislation for switching regimes which makes compliance easier.

- It protects the taxpayer from making mistakes or even disputes over getting into the wrong regime.

FAQs on Income Tax Slab

- Who makes changes to the income tax slabs in India?

The changes to the income tax slabs in India are proposed by the Finance Ministry of India.

- Is ₹12 lakh income completely tax-free under the new regime?

Yes, with a ₹75,000 standard deduction and ₹60,000 rebate, income up to ₹12 lakh becomes tax-free.

- What is the standard deduction for FY 2026–27?

Salaried and pensioned taxpayers get a standard deduction of Rs.75,000 under the new tax regime.

- Can I change tax regimes every financial year?

Yes, salaried taxpayers can switch between regimes each year by filing Form 10-IE.

- Are senior citizens eligible for the new regime?

Yes, they can opt for the new regime, though the old regime offers higher exemption limits by age.

- When are the changes to the income tax slabs in India proposed?

The changes to the income tax slabs in India are announced by the finance minister of the country. This proposal is usually made when the annual budget is announced every year in the month of February.

- Who should prefer new tax regime?

If your tax deductions total less than Rs.3.75 lakh and you earn Rs.20 lakh, the new system will benefit you. Otherwise, choose the previous tax system.

- How Rs.12 lakh income is tax free under the new regime?

For income up to Rs.12 lakh, no tax needs to be paid. Under the new regime, there is a rebate of Rs.60,000.

- What is the disadvantage of new tax regime?

There are fewer exemptions and deductions available under the new tax system. Only a select handful are available, such as the standard deduction, leave travel reimbursement, and tax-free Provident Fund withdrawals.

- Who can claim rebate under Section 87A?

Rebate under Section 87A can be claimed by any resident Indian whose total annual income up to Rs.7 lakh as per the new regime.

- Which tax regime is better for Rs.5 lakh salary?

The tax deduction is 5% for both the regimes if your annual salary is Rs.5 lakh. Have a look at the investments you have made and the ways in which you would like to have tax exemptions based on which you can decide which tax regime will be suitable for you.

- Which tax regime is better for Rs.15 lakh?

The standard deduction is 30% for both tax regimes. However, if you have investments through which you would like to enjoy tax exemptions then opt for the old tax regime otherwise the new tax regime will work.

- Which tax regime is better for Rs.12 lakh p.a.?

Under the old tax regime, the tax deduction is 30% while for the new tax regime it is 15%. However, based on your investments and other tax saving procedures take a call to see which of the two regimes are suitable for you. If you don’t have any investments, then opt for the new tax regime, otherwise choose the old tax regime.

- Are there separate income slab rates for different categories?

Yes, there are separate income slab rates for different income categories such as income below Rs.2.50 lakh, more than Rs.2.50 lakh, and more than Rs.5 lakh has applicable tax rate of zero, 5.00%, and 10%.

- What is the new regime of income tax?

The new tax regime was introduced in 2020 where various concessions are included and tax rates have been altered under this new tax regime.

- Is 80C available in the new tax regime?

No, 80C deduction is not available in the new tax regime which is available only under old tax regime.

- Is the standard deduction of Rs.75,000 applicable in the new tax regime?

Yes, a standard deduction of Rs.75,000 is applicable in the new tax regime from the financial year 2026-2027.

- Which deductions are not allowed in the new tax regime?

Sections 80C, 80D, 80E, leave travel concession, house rent allowance, interest on home loans (Section 24b), SEZ unit exemption, standard deduction, deduction for entertainment allowance, and various other deductions under Sections 32AD, 33AB, 33ABA, 35AD, and 35CCC are not allowed.

- Can I switch the Income tax regime each year?

Yes, you can switch the income tax regime as per requirement every year. The taxpayer can switch the tax regime while filling in the Income Tax Return.

- Do I have to mandatorily opt for a new tax regime while filing returns for FY 2026–27?

No, it is not mandatory to opt for a new tax regime while filing returns for FY 2026-2027. Taxpayers have the freedom to select between new and old tax regimes at the beginning of the year, while it can be modified while filing tax returns.

- Is the due date for filing an income tax return the same for all taxpayers?

No, the due date for filling income tax returns is not the same for all employees. The due date for individual taxpayers is 31 July of the assessment year.

- Who decides the IT slab rates and can they change?

Yes, IT slab rates change and are decided by the government. The change in the IT slab rates for the financial year are first introduced in the budget and presented in the parliament.

- Do I need to file Income Tax Return if my annual income is below Rs.3 lakh?

You need not file an ITR if your yearly income is below Rs.3 lakh under new regime but you should file a 'Nil Return' just for the record as there are many cases where you can produce them as proof of your employment. For instance, you can provide your ITR while applying for a loan or passport.

- How is the income of a taxpayer classified?

Under Section 14 of the Income Tax Act, the taxpayer's income has been classified under 5 different income heads such as Salaries individuals, Capital gains, Gains/Profits from profession or business,Income from house property, Income from other sources.

- Is income up to Rs.5 lakh tax-free?

No, income up to Rs.5 lakh is not tax-free. However, individuals who earn an income of up to Rs.3 lakh under the new regime do not have to pay tax.

- Will there be any standard deductions for the financial year 2026-2027?

Yes, for the financial year 2026-2027, Rs.75,000 will be the standard deduction under the new regime.

- Will there be different tax slabs for various categories?

Depending on the income and age of the individual, the tax slab he/she will fall under will vary.

News About Income Tax Slab and Rates

Union Budget 2025: New Income Tax Slabs

Under the Union Budget 2025, the Finance Minister announced new income tax slabs as follows:Rs.0 to Rs.4 lakh: Nil; Rs.4 lakh to Rs.8 lakh: 5%; Rs.8 lakh to Rs.10 lakh: 10%; Rs.12 lakh to Rs.16 lakh: 15%; Rs.15 lakh to Rs.20 lakh: 25%; and above Rs.25 lakh: 30%.

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.